Digital transactions in India highest in world but why is cash still king?

New Delhi, June 2, 2023

The Reserve Bank of India believes that households in India hold more high-value currency notes at home while substituting lower-value notes with digital transactions

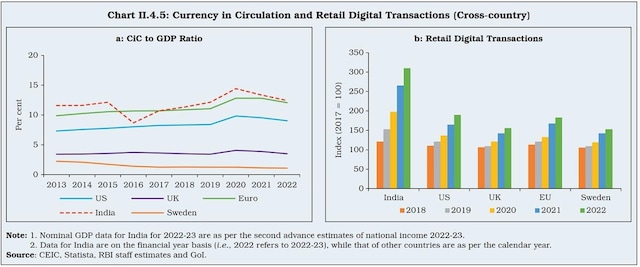

India's Unified Payments Interface (UPI)-led retail digital payments grew at a compounded annual growth rate (CAGR) of 50 per cent in the last five years, with digital transactions surpassing all major developed economies, including the US, the UK, and Europe, said the Reserve Bank of India in its annual 2022-2023 report.

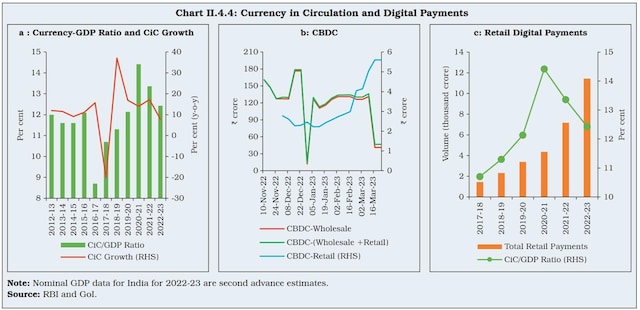

"In India, while the UPI-led retail digital payments grew at a compounded annual growth rate (CAGR) of 50 per cent and 27 per cent in terms of volume and value, respectively (during 2016-17 to 2021-22), the currency in circulation (CIC) to GDP ratio also rose and peaked at 14.4 per cent in 2020- 21," RBI wrote.

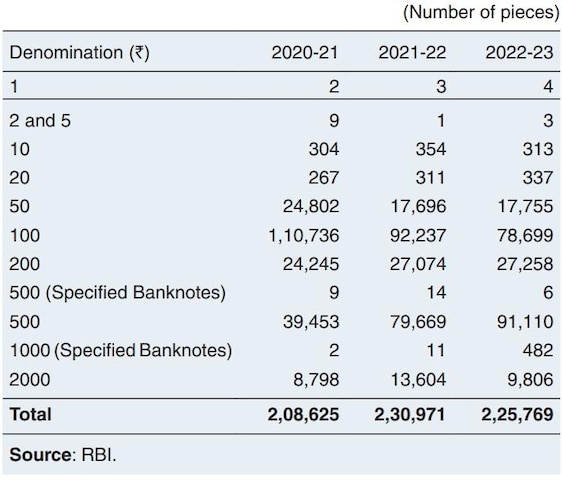

RBI also noted a decline in the share of low denomination notes, partly due to the substitution of small value payments by the UPI and mobile wallets, corroborated by their narrowing ticket sizes.

Lower transactional cash demand is also evident from the sharper decline in the number of cash withdrawals at ATMs than in the withdrawal values, leading to increased withdrawal sizes.

But why is the currency in circulation rising when digital payments are soaring?

The central bank believes that households in India hold more high-value currency notes at home while substituting lower-value notes with digital transactions.

"The persistent affinity for cash has been attributed to factors such as the decline in opportunity costs of holding currency, i.e., interest rates, precautionary holdings amid uncertainty, presence of a large informal economy and direct benefit transfers (DBTs) by the government, promoting both cash and digital modes, as routing of benefits digitally tends to be followed by cash withdrawals," said the RBI.

The Covid-19 pandemic increased the demand for cash further.

"The increase in currency demand during Covid-19 in India was primarily for precautionary motive as the strong growth in CiC was driven by the demand for high denomination notes that witnessed a jump in its share to 90 per cent of total CiC in 2021-22 from the average of 82 per cent during 2010-16. In addition, there was a decline in the share of low denomination notes, partly due to the substitution of smallvalue payments by the UPI and mobile wallets, corroborated by their narrowing ticket sizes," it said.

The RBI attributed the sudden uptick in CiC growth during Covid-19 can be attributed to the precautionary and store-of-value motives, even as the transactional use of cash has progressively been substituted by digital modes.

However, it said recent data suggest a turnaround in the pandemic-induced precautionary demand for cash. For the week ending March 24, 2023, the CiC grew by 7.8 per cent year-on-year (YoY), i.e., recording single-digit growth for 86 weeks since August 2021 (barring April 2022) and averaging overall at 8.5 per cent. Concurrently, digital payment modes continue to maintain strong growth momentum post-Covid.

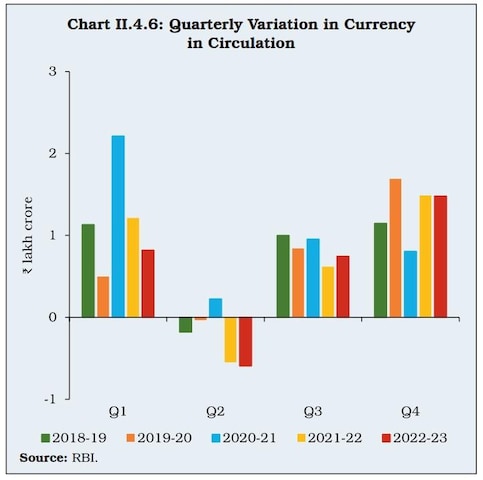

Also this: During 2022- 23, variations in CiC during Q3 and Q4 were also influenced by assembly elections in six states.

The value and volume of banknotes in circulation increased by 7.8 per cent and 4.4 per cent, respectively, during 2022-23, as compared with 9.9 per cent and 5.0 per cent, respectively, during 2021-22. In value terms, the share of Rs 500 and Rs 2000 banknotes together accounted for 87.9 per cent of the total value of banknotes in circulation as on March 31, 2023, as compared to 87.1 per cent as on March 31, 2022.

In volume terms, Rs 500 denomination constituted the highest share at 37.9 per cent, followed by Rs 10 denomination banknotes which constituted 19.2 per cent of the total banknotes in circulation as on March 31, 2023

More fake notes in circulation

During 2022-23, out of the total Fake Indian Currency Notes (FICNs) detected in the banking sector, 4.6 per cent were detected at the Reserve Bank and 95.4 per cent at other banks.

Denomination-wise Counterfeit Notes Detected in the Banking System (April to March)

Compared to the previous year, there was an increase of 8.4 per cent and 14.4 per cent in the counterfeit notes detected in the denominations of Rs 20 and Rs 500 (new design), respectively.

Fake notes detected in the denominations of Rs 10, Rs 100 and Rs 2,000 declined by 11.6 per cent, 14.7 per cent and 27.9 per cent, respectively.

[The Business Standard]