EPFO issues FAQs on higher EPS pension, but no clarity on computation

New Delhi, May 11, 2023

Synopsis

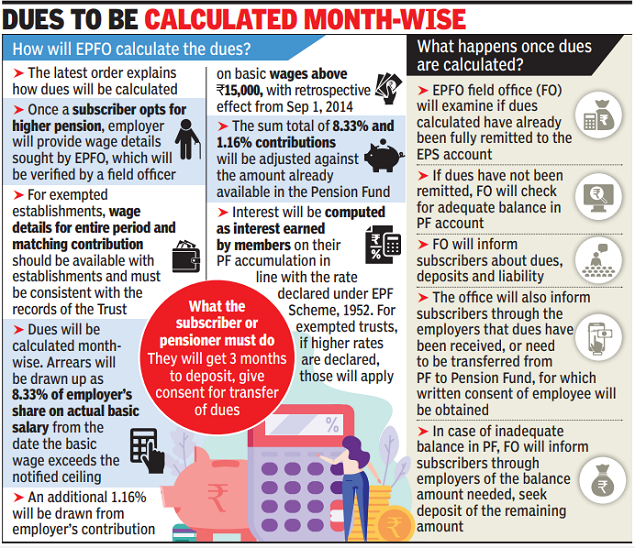

EPFO said applicants will have up to three months to provide written consent to EPFO to either draw arrears from their PF, or to deposit funds separately in case of a shortfall in their PF kitty.

Seeking to put an end to widespread confusion over higher pension, the Employees’ Provident Fund Organisation (EPFO) has explained how it will calculate the amount subscribers need to move from their provident fund to the pension fund. It has, however, not yet disclosed the details regarding the method for computation of pension, which will come subsequently.

The computation method will provide the formula to ascertain the amount a member is likely to receive as pension at the time of retirement. For now, eligible subscribers, who are interested in signing up for the higher pension, will be able to assess their prospective liability, including the interest payable, towards the pension fund.

EPFO said applicants will have up to three months to provide written consent to EPFO to either draw arrears from their PF, or to deposit funds separately in case of a shortfall in their PF kitty. Under the prevailing EPS-1995, pension is computed by multiplying the average of actual basic salary of the last five years of service with the years for which a person has been a subscriber of PF, and dividing the total by 70.

Although the deadline for application has been deferred to June 26, in the absence of clarity from EPFO on whether the same formula will apply or a modification will follow, subscribers will not be able to accurately calculate how much pension they are likely to receive after retirement — a necessary prerequisite to make the final decision.

What the latest circular does is to clarify how EPFO will calculate the dues payable for each subscriber once the field office receives and verifies all information, including employees’ wage details, from employers. In all instances where the joint options for higher pension are found valid, employees will receive demand letters from EPFO notifying them about the total amount due and the amount that needs to be transferred, along with interest, from the provident fund. If the PF does not have enough funds, the amount needs to be deposited along with interest.

To calculate the dues, EPFO will add 8.33% of the employers’ contribution towards an employee’s actual basic salary from the day it exceeded the notified cap (of Rs 5,000 till June 2001, Rs 6,500 till 2004, or Rs 15,000 from September 2014) to an additional 1.16% from the employer’s contribution on basic salary pay above Rs 15,000 per month.

The total will be adjusted against the amount already available in an employee’s pension fund. Each member’s case will be processed separately, and interest will be applicable on dues in proportion to the interest earned by members on their PF accumulations as declared under the EPF Scheme, 1952. In case of exempted trusts, if higher interest rates were declared, those shall apply.

Once the calculation of dues is completed, the EPFO field offices will issue demand letters to employees about the dues that need to be transferred from the PF account.

[The Economic Times]