Mutual fund returns:

Can recent Sebi mandate of disclosing risk-adjusted return help you identify the right mutual fund?

July 8, 2024

Synopsis

Mutual fund investments: Recent surges in investments in certain fund categories and schemes have raised concerns. Investors flock to funds with stellar recent returns, sometimes overlooking the associated high risks. Sebi aims to ensure investors consider not just performance, but also the risks involved. Risk-adjusted returns offer a more comprehensive view of fund performance, according to Sebi. Will it ultimately help the mutual fund investors?

Sebi has put the spotlight on risk in mutual funds again. It has proposed that all mutual funds mandatorily disclose risk-adjusted return, not just the return. This risk-adjusted return is to be recorded in the form of ‘information ratio’.

The information ratio essentially measures how much excess return a fund generates relative to the excess risk it takes, compared to its benchmark. It’s calculated by dividing the active return (fund’s return, minus its benchmark index) by the tracking error (standard deviation of active return). A higher ratio indicates better risk-adjusted performance, reflecting how well a fund performs relative to its benchmark while considering volatility.

Why is Sebi pushing for this disclosure now? Recent surges in investments in certain fund categories and schemes have raised concerns. Investors flock to funds with stellar recent returns, sometimes overlooking the associated high risks. Sebi aims to ensure investors consider not just performance, but also the risks involved. Risk-adjusted returns offer a more comprehensive view of fund performance, according to Sebi.

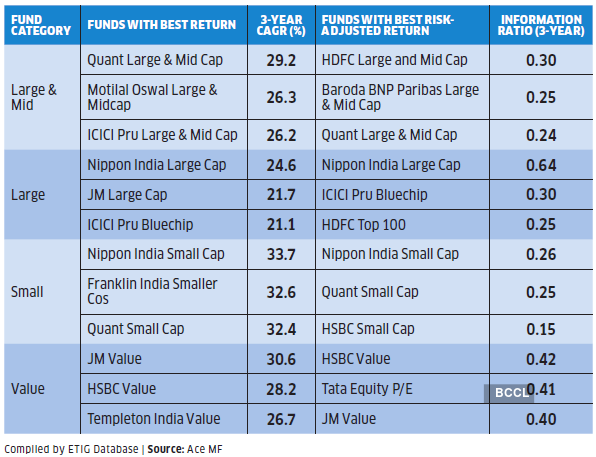

Table toppers may not always suit your risk

Some funds have taken higher risk to generate excess return.

Currently, not all fund houses disclose risk-adjusted returns. Sebi has observed that out of the 39 fund houses running equity schemes, 33 disclose the figure. Of the 36 fund houses running hybrid schemes, just 27 disclose their risk-adjusted return numbers. Further, AMCs do not follow a uniform methodology for calculating risk-adjusted return, as well as the frequency of NAVs used for the same. Sebi wants to standardise the metric in the form of information ratio.

Will this additional disclosure give you a better picture of the underlying risk? It is true that relying on a fund’s past return alone can be misleading. Two funds may have delivered similar return, but taken contrasting risk to generate that return. Or, a fund that is vastly outpacing the rest may also be taking a far higher risk. A fund that is taking on lower risk will typically deliver a return more consistently even if it does not deliver an outsized return. Another fund may occasionally deliver chart-topping returns, but exhibit sharply divergent outcomes along the way.

If this is captured as a number, you get a clear picture of what you are getting into. For instance, among large- and mid-cap funds, Quant Large & Mid Cap has comfortably outscored its peers in the past three years, yet is behind HDFC Large & Mid Cap and Baroda BNP Paribas Large & Mid Cap in risk-adjusted return, as captured by the information ratio. Similarly, JM Value has topped the charts among value funds, but finds itself behind HSBC Value and Tata Equity P/E in risk-adjusted return. Clearly, the two chart-toppers have been comparatively erratic in delivering outperformance.

To be sure, investors are not unfamiliar with risk measures. Metrics like the standard deviation and Sharpe ratio are already captured in fund factsheets. Standard deviation measures the dispersion in a fund’s return, indicating its susceptibility to volatility. The Sharpe ratio measures a fund’s return relative to the risk-free rate of return and adjusts it for volatility. Both these metrics have their limitations, of course.

Information ratio has its uses, but will not be relevant for most investors, say experts. Rushabh Desai, Founder, Rupee with Rushabh Investment Services, remarks, “Most of these ratios are very technical and cannot be interpreted by lay investors.” It is an overload of information for the investor, insists Vidya Bala, Head, Research, Primeinvestor.in. “At times, a fund may appear better on its Sharpe ratio compared to its information ratio. It is not easy for the investor to decide which is more relevant,” argues Bala. Mahesh Mirpuri, Founder, Invest Mutual, adds that such ratios have limited utility considering how fund managers keep changing. “The ratios quickly lose their relevance when a fund manager exits. What matters more is the fund house process and investing style,” he says.

Besides, information ratio has its shortcomings. Though it can tell whether a fund outperformed its benchmark on a risk-adjusted basis, it cannot specifically say how the outperformance was achieved. “Information ratio will not be able to show the complete picture. It won’t tell you if it was the fund’s investing style that clicked in that period, or if it was pure luck,” Desai argues. Growth-style funds were delivering superior outperformance for many years till market preferences shifted to value, leaving the former on shaky ground. No ratio will capture this cyclicality in performance. Experts insist that a fund’s rolling return is a better all-round measure to capture a fund’s performance. It can reveal how consistently the fund outperformed and by what margin.

[The Economic Times]