New accounting standard for insurance soon

July 18, 2023

Synopsis

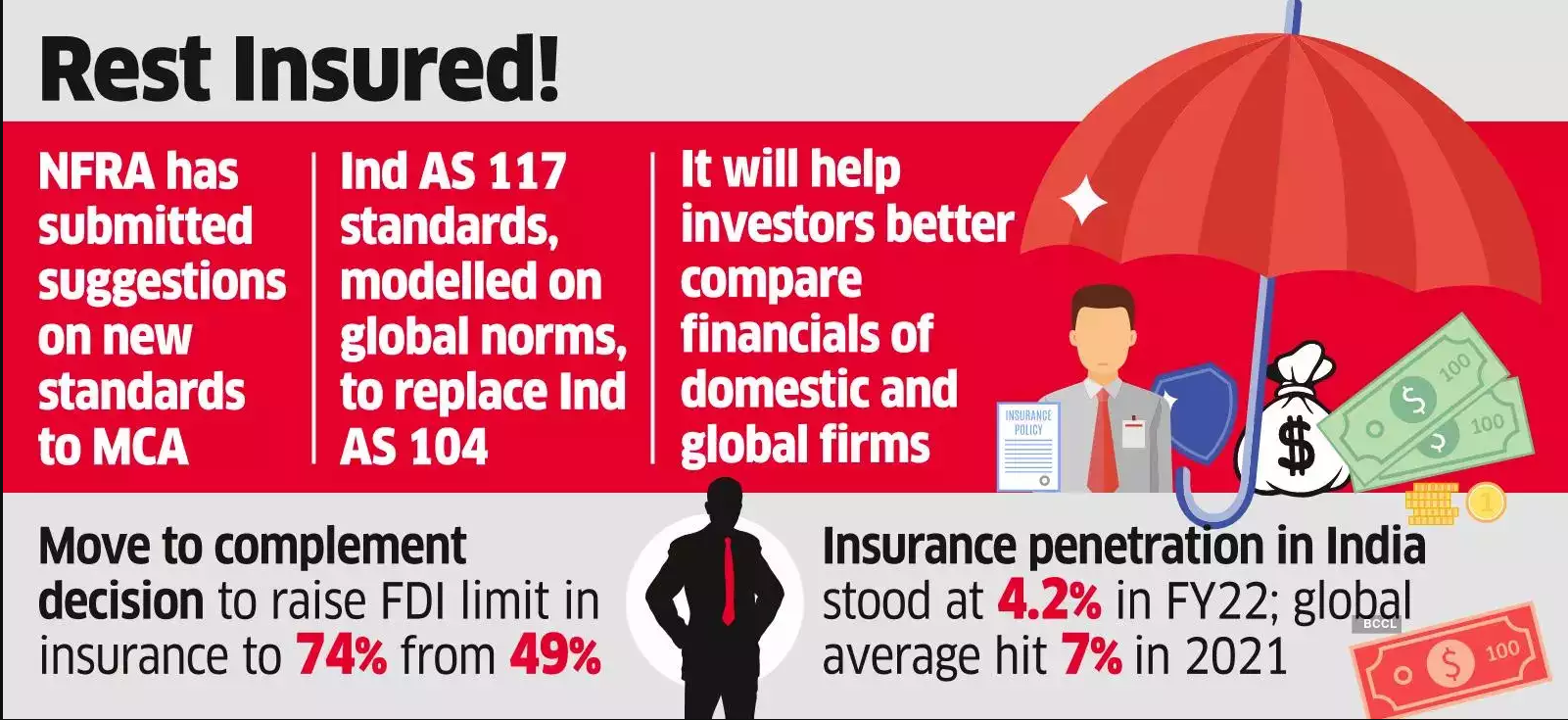

The ministry of corporate affairs (MCA) has received recommendations by the National Financial Reporting Authority (NFRA) on the Indian Accounting Standard (Ind AS) 117 for insurance contracts, he told ET."The NFRA's suggestions are being evaluated. The standards will soon be notified under the Companies (Indian Accounting Standards) Rules 2015," he added.

The government will soon notify a new accounting standard for insurance contracts, which would align Indian norms with international practices and help global investors better gauge the risk exposure of domestic insurers, a senior official said.

The ministry of corporate affairs (MCA) has received recommendations by the National Financial Reporting Authority (NFRA) on the Indian Accounting Standard (Ind AS) 117 for insurance contracts, he told ET.

"The NFRA's suggestions are being evaluated. The standards will soon be notified under the Companies (Indian Accounting Standards) Rules 2015," he added.

Subsequently, the insurance regulator could announce the date of adoption of the new standards by relevant entities, he said. The new standards will replace the current Ind AS 104, Insurance Contracts.

The new standards, modelled on the IFRS 17 issued by the International Accounting Standard Board, will help draw foreign direct investment (FDI) into the insurance sector and also deepen insurance penetration in the country. This is because international investors would be able to better compare the financials of domestic insurers with those of their global peers, he said.

The new framework would require domestic insurers to further bolster their disclosure needs, leading to greater transparency and informed decision-making.

The government had in 2021 raised the FDI limit in insurance to 74% from 49% and allowed foreign ownership and control of these firms with certain safeguards.

IFRS 17, the global standards, are specifically designed to capture the unique features of the insurance and investment contracts of various insurance entities.

The NFRA held extensive consultations with the Insurance Regulatory Development Authority of India and other stakeholders, including companies and the Institute of Chartered Accountants of India, before firming up the recommendations.

NFRA chairman Ajay Bhushan Pandey had said in April that Ind AS 117 would be substantially converged with IFRS Standard adopted in over 140 countries.

The insurance penetration in India stood at 4.2% in FY22, while the global average hit 7% in 2021. However, the domestic market is growing at a faster pace. Real premium in India grew 7.8% in 2021, more than double the global average of 3.4%.

IASB's fact sheet of 2017 says, with $13 trillion in assets, insurers account for 12% of the total assets of listed companies that use IFRS Standards.

[The Economic Times]