KPMG’s Big Four Dominance on Bank Audits Shaken by Failures

June 22, 2023, 2:30 PM

Three failed audit clients re-expose KPMG’s historical problems

Firm response to rapid interest rate rise under question

Big Four accounting firm KPMG has been buffetted by one of the biggest economic stories of the year—and has been pilloried for giving clean audit opinions for three banks that collapsed amid the interest rate crisis that’s threatened the regional banking sector.

The immediate risks to those mid-tier lenders might have subsided, but that doesn’t put KPMG in the clear. The firm faces congressional scrutiny over its relationships with the banks, while shareholders have sued KPMG over its audits of at least one of the banks that collapsed into FDIC receivership.

And KPMG’s sizable regional bank portfolio leaves open the possibility of another client collapsing amid rising interest rates that have reduced the value of the capital banks have on hand to cover hefty customer withdrawals. Federal Reserve Chairman Jerome Powell told a House committee Wednesday that Fed officials anticipate that rates will rise further before the end of the year.

“I want to believe that that you can issue an audit opinion and that company is going to be in business for at least another month,” said Tony Menendez, assistant professor of accounting at Loyola Marymount University. “My concern is that it goes beyond KPMG.”

The bank turmoil also serves as a test of audit standards and the question of whether routine financial statement audits live up to their promise to protect shareholders’ investments.

KPMG has maintained that it followed US audit standards and has said it will cooperate with a Senate probe into its relationships with the banks.

“KPMG has long had a substantial and dynamic audit practice in the financial services industry. The firm continues to stand by its audits,” it said in a statement.

Risky Business

KPMG has built up its audit practice to cater to banks, from giants like Citigroup to regional banks like PacWest, which was forced to shore up its liquidity after its stock plunged this spring.

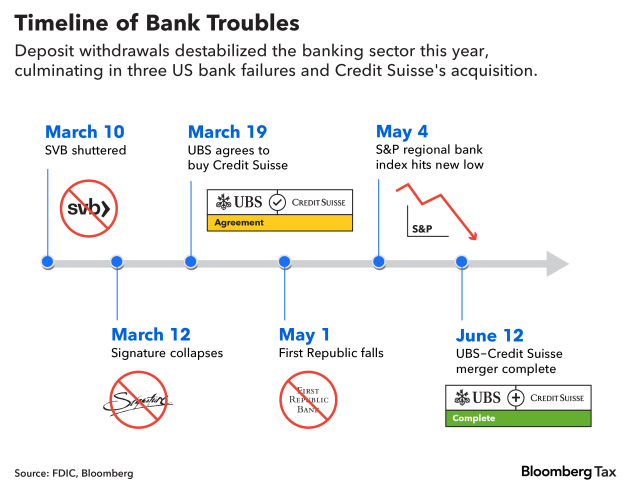

Regional banks stocks plummeted after the March collapse of SVB and Signature Bank. Inflation and rising interest rates continue to hamper the US banking sector after customers pulled billions of dollars worth of deposits in the first quarter. KPMG’s outsized role in auditing financial institutions, including regionals, created outsized exposure to any downturn.

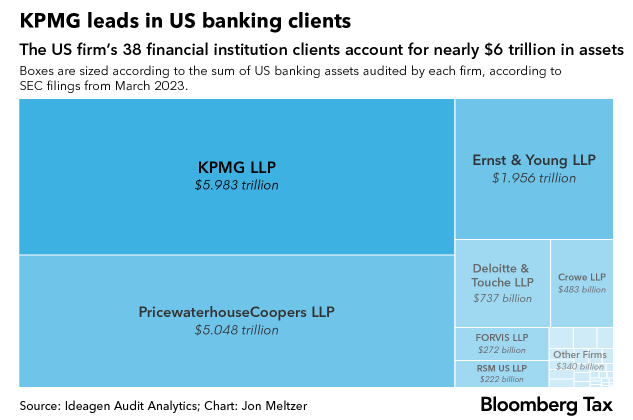

KPMG still dominates the US financial institution market with its audit clients representing 40% of bank assets, according to Ideagen Audit Analytics data on SEC filers. PwC ranks second.

Rising treasury yields meant that the bonds banks already held on their balance sheets were worth far less than they had just months earlier, putting at risk their ability to cover those vast deposit withdrawals. Unrealized losses totaled $515.5 billion in the first quarter across the assets all banks intended to quickly sell along with longer-term holdings.

“You don’t have to be a Big Four accounting firm to be smart enough to realize there’s a risk there,” plaintiffs attorney Steven Thomas said of interest rate risks. “It should have been hitting KPMG in the face, this risk.”

Thomas, a partner with Thomas, Alexander & Forrester LLP, represented the FDIC as it pursued PwC LLP in court for its failed audits of Colonial Bank, which collapsed during the 2008 financial crisis.

More recently, SVB, Signature and First Republic each collapsed into FDIC receivership after KPMG issued clean audit opinions on their financial health. And the firm, which already faces shareholder suits, could also face legal reprisals from either the FDIC or certain uninsured depositors or other stakeholders.

While auditors aren’t expected to predict bank runs, they are responsible for monitoring shifts in the market and considering how those changing dynamics could alter the accuracy of the financial statements or put at risk a company’s ability to remain a viable going concern. The degree to which auditors are responsible for bank failures caused by mismanagement is a matter of debate.

Jung Lee, a director with Johnson Global Accountancy, works with audit partners worried about similar runs at their clients. If concerns come up at the 11th hour, auditors should hold their opinions as they reassess those shifts in the market, said Lee, who is also a former inspections leader at the Public Company Accounting Oversight Board.

Lingering Challenges

This isn’t the first time KPMG has come under scrutiny for its bank audits, both in the US and internationally. In particular, its audits for Wells Fargo and Credit Suisse, which was recently acquired by competitor UBS, have brought criticism and litigation. Among other instances:

A Credit Suisse shareholder in the US claims KPMG, which the bank replaced with PwC in 2020, should not have been retained for over two decades as the international bank’s auditor, in part, its suit alleges, because of the accounting firm’s past “misconduct.” The suit listed more than 30 examples spanning the globe.

British regulators said in the summer of 2021 that they had found an “unacceptably high” number of KPMG’s bank audits weren’t good enough and gave the UK affiliate a list of changes needed to address the shortfalls.

And in 2019, KPMG paid a $50 million settlement to US regulators over a scheme to cheat on its PCAOB inspections—a plot that was intended to improve the results of those annual reviews, including the firm’s bank audits. Instead it resulted in criminal convictions for six people involved in the scandal and the pricey SEC penalty.

To turn around its audit performance, KPMG has instituted leadership changes and separated its internal inspections program from its core assurance practice, among other changes.

In one promising sign, KPMG’s US inspection results have steadily improved in recent years amid major investments in its core audit platform to tether its audit techniques with audit standards and to harness tools that scrutinize full sets of transactions and spot anomalies.

The trio of US bank failures, however, calls into question whether its reforms were sufficient.

Too Big to Change

Beyond KPMG, the failures have put pressure on the standards under which auditors operate—rules set by the PCAOB.

“It not only affects the reputation of the audit firm involved, but also tarnishes the credibility of the entire public accounting profession and the audit process,” said Mary-Jo Kranacher, an accounting professor at York College, part of the City University of New York system.

Uncovering how KPMG responded to risks at the three banks is necessary to understand if its actions were in line with what another auditor would have done and whether such typical steps should be revised, Menendez said.

“Are they too big to fail or is the profession too big to change,” he said. “Maybe it’s time to rethink what we’re doing in order to provide value to the markets.”

The PCAOB, which declined to comment for this article, has set an ambitious agenda to modernize its rules for how auditors assess whether a company remains a viable going concern and would set a higher bar for how firms monitor the quality of their work, among other changes. The board has also stepped up enforcement of its rules. Interest rate risks are slated to get extra scrutiny as the board inspects the work on fiscal year 2022 audits as well.

Those after-the-fact reviews aren’t enough, said Sarah Williams, an assistant law professor at Penn State University and a former deputy director of the PCAOB’s inspection division.

The challenges and red flags facing KPMG should be considered “holistically.” And the regulator should paint a clearer picture of audit performance by reporting factors like compensation, operations, enforcement penalties and the rate at which audit team members take jobs at their former clients, Williams said.

Inspecting only for issues related to the bank crisis, Williams said, “is like using a garden hose to put out a major fire.”

[Bloomberg Tax News]